Manhattan Institute Proxy Monitor Finding 6

2011 Proxy Midterm

Executive Pay Proposals Winning Support

Continuing Labor Union Efforts Throw Spotlight on Fiduciary Performance

As the 2011 proxy season for public companies unfolds, the efforts of labor union pension funds to exert influence over corporate governance are garnering increased attention. The AFL-CIO has launched a concerted effort to push back against management through shareholders’ executive pay votes, now-mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act. A report of the U.S. Department of Labor’s Office of Inspector General throws into question the extent to which labor union pension funds’ activities in the corporate-governance arena are consistent with such funds’ fiduciary obligations.

To explore these and other trends, this sixth Proxy Monitor “finding” examines the results to date of votes taken during the 2011 proxy season, which has just passed its midpoint. As of May 16, 57 of the Fortune 100 companies in the Manhattan Institute’s ProxyMonitor.org database have held their annual meetings. This finding provides:

- An update on the composition of shareholder proposals and voting results thus far;

- A review of “say on pay” votes mandated under Dodd-Frank; and

- A look at labor-union pension fund activity in the proxy season.

1. An update on the composition of shareholder proposals and voting results thus far

Continuing the early trend described in Finding 5, [1] the percentage of shareholder proposals related to executive compensation in 2011 is substantially lower than in 2008-2010: such proposals only constitute 14 percent of shareholder proposals to date in 2011, as opposed to 30 percent over the prior three years.[2] This trend is likely attributable to the new rule under Section 951 of Dodd-Frank that requires a non-binding shareholder vote on executive pay plans for all public companies. These management proposals obviate the need for such “say on pay” shareholder proposals, which constituted a significant share of all executive-compensation-related proposals from 2008-2010. Thus far in 2011, none of the executive-compensation shareholder proposals submitted to Fortune 100 companies have passed, though proposals related to equity incentive and stock option plans submitted to Sunoco and Walgreen Co. each garnered the support of over 40 percent of shareholders.

Among the 38 percent of shareholder proposals related to corporate governance, proposals calling for directors to be elected by a majority vote of shareholders, and those authorizing shareholders to act outside of annual meetings by written consent, are relatively more likely to pass. This is in keeping with prior patterns.[3] In this proxy season, majority-voting standards have been adopted by the shareholders of Apple and Prudential,[4] and the shareholders of AT&T, International Paper, and CVS voted in favor of proposals authorizing shareholder action by written consent.

Among the 38 percent of shareholder proposals related to corporate governance, proposals calling for directors to be elected by a majority vote of shareholders, and those authorizing shareholders to act outside of annual meetings by written consent, are relatively more likely to pass. This is in keeping with prior patterns.[3] In this proxy season, majority-voting standards have been adopted by the shareholders of Apple and Prudential,[4] and the shareholders of AT&T, International Paper, and CVS voted in favor of proposals authorizing shareholder action by written consent.

Shareholder proposals unrelated to corporate governance or executive compensation—which we group together as “social policy” proposals—account for 48 percent of all shareholder proposals to date in 2011. In keeping with the early trends described in Finding 5,[5] a plurality of such proposals, 37 percent, involve requiring corporations to disclose political spending and/or lobbying expenditures. As was true over the 2008-2010 period, none of the social-policy proposals received majority support; four of the proposals related to political spending garnered the support of at least 30 percent of shareholders, at Bank of America, 3M, IBM, and AT&T.

2. A review of “say on pay” votes mandated under Dodd-Frank

Under Dodd-Frank’s new Section 951 rules, public companies generally must submit to shareholders both an advisory vote on 2011 executive pay packages and a “frequency” vote to determine whether shareholders wish to review such compensation annually, biennially, or triennially. In total, the 57 Fortune 100 companies that have held annual meetings to date have held 111 votes on these measures.[6]

Consistent with earlier findings,[7] shareholders are overwhelmingly opting for annual review of pay packages—a position supported by the proxy-advisory firm Institutional Shareholder Services (ISS). Among the companies in the Proxy Monitor database, only companies with large insider holdings or dual-class equity voting structures—Berkshire Hathaway and Tyson Foods—have seen shareholders approve a management recommendation for triennial review. Boards have increasingly been recommending annual say-on-pay votes, in keeping with this trend.

Hewlett-Packard remains the only Fortune 100 company for which a majority of shareholders have rejected a proposed executive-compensation package,[8] and two-thirds of companies have garnered support from at least 85 percent of voting shares. Certain other companies where executive pay was targeted by organized labor did get relatively thin majority support for their pay packages, including Pfizer (55 percent) and Johnson & Johnson (61 percent). The public employee labor union American Federation of State, County, and Municipal Employees (AFSCME) has announced its opposition to the executive pay plan at Exxon Mobil,[9] which holds its annual meeting on May 25. The ISS supports AFSCME’s position.[10] Those interested in the influence of proxy-advisory firms and organized labor over proxy voting will doubtless be watching the oil giant’s meeting with interest.

3. A look at labor-union pension fund activity in the proxy season

As suggested in our winter report and in earlier findings, the empirical data suggest that labor union pension funds may be participating in the shareholder proxy process not out of regard for their fiduciary obligation to maximize risk-adjusted investment returns but instead as an avenue to pursue labor’s negotiating interests vis-à-vis management.[11] Amplifying this concern, the AFL-CIO has launched an "Executive Pay Watch" website for this proxy season as part of a campaign against high executive pay, but such efforts are notably focused on the ratio of CEO pay to workers' pay rather than on maximizing risk-adjusted share return.[12]

As suggested in our winter report and in earlier findings, the empirical data suggest that labor union pension funds may be participating in the shareholder proxy process not out of regard for their fiduciary obligation to maximize risk-adjusted investment returns but instead as an avenue to pursue labor’s negotiating interests vis-à-vis management.[11] Amplifying this concern, the AFL-CIO has launched an "Executive Pay Watch" website for this proxy season as part of a campaign against high executive pay, but such efforts are notably focused on the ratio of CEO pay to workers' pay rather than on maximizing risk-adjusted share return.[12]

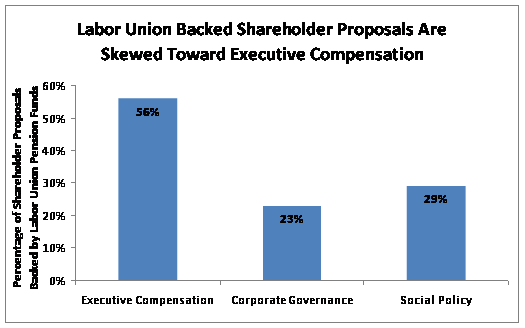

As shown in the above graphs, labor union pension funds continue to be substantially more interested in challenges to executive compensation than in other shareholder proposals. Moreover, fully half of the social-policy proposals supported by labor union pension funds have involved corporate political spending.

Concerns about whether labor union pension funds are acting in accordance with their fiduciary obligations to plan participants were highlighted in a March 31 report of the Office of the Inspector General at the U.S. Department of Labor (OIG), which found that “[t]he Employee Benefits Security Association (EBSA) does not have adequate assurances that fiduciaries or third parties voted proxies solely for the economic benefit of plans.”[13] The OIG report went on to note that “[w]ithout additional transparency and enhanced enforcement activities, concerns about the fiduciary use of plan assets to support or pursue proxy proposals for personal, social, legislative, regulatory, or public policy agendas, which have no clear connection to increasing the value of investments used for the payment of benefits or plan administrative expenses, may not be properly addressed.” Further transparency, in addition to empirical data gathered from Proxy Monitor and other sources, would be useful in assessing whether labor union pension funds’ aggressive role in sponsoring shareholder proposals is consistent with those funds’ fiduciary obligations.

This report analyzes information gathered from the Manhattan Institute’s ProxyMonitor.org database, which contains information relating to all shareholder proposals submitted for shareholder vote since 2008, for the 100 largest American public companies.

ENDNOTES

- See Manhattan Institute Proxy Monitor Finding 5 (2011), available at http://www.proxymonitor.org/Forms/Finding5.aspx.

- See Manhattan Institute Proxy Monitor Report (Winter 2011), available at http://www.proxymonitor.org/Forms/Reports.aspx.

- As discussed in Finding 3, over the 2008-2010 period, 70 percent of shareholder proposals calling for a majority vote for directors and 78 percent of those calling for shareholders to be able to act through written consent outside the annual meeting process were approved among the Fortune 100 companies in the Proxy Monitor dataset. See Manhattan Institute Proxy Monitor Finding 3 (2011), available at http://www.proxymonitor.org/Forms/Finding3.aspx.

- Prudential’s board recommended that shareholders vote in favor of the proposal calling for majority voting, leading the measure to be approved by over 98 percent of shares outstanding.

- See Manhattan Institute Proxy Monitor Finding 5 (2011), available at http://www.proxymonitor.org/Forms/Finding5.aspx.

- Because Dodd-Frank’s Section 951 only went into effect on January 21, Walgreen, which held its meeting on January 12, was not required to hold such votes in 2011. AIG, substantially owned by the federal government, only proposed a “say on pay” review vote and did not submit a vote on the frequency of such review in 2011.

- See Manhattan Institute Proxy Monitor Findings 1, 5 (2011), available at http://www.proxymonitor.org/Forms/Findings.aspx.

- The shareholders of twelve further companies outside the Fortune 100 have rejected pay plans, according to ISS. See http://blog.riskmetrics.com/gov/2011/05/a-13th-investor-protest-over-executive-pay.html.

- See http://blog.riskmetrics.com/gov/2011/05/activist-investors-object-to-exxonmobils-pay-practices.html.

- See http://online.wsj.com/article/SB10001424052748703864204576315552746244160.html

- See Manhattan Institute Proxy Monitor Report (Winter 2011), available at http://www.proxymonitor.org/Forms/Reports.aspx; Manhattan Institute Proxy Monitor Findings 1, 3, 4, 5 (2011), available at http://www.proxymonitor.org/Forms/Findings.aspx.

- See http://www.aflcio.org/corporatewatch/paywatch/index.cfm.

- See http://www.governanceprofessionals.org/society/Department_Of_Labor_Office_of_Inspector_General_Is.asp?SnID=2.