PROXY MONITOR 2014

FINDING 5

Frequent Filers: Shareholder Activism by Corporate Gadflies

Seventy percent of 2014 individual-sponsored shareholder proposals have been introduced by three people and their family members.

By James R. Copland

ABOUT PROXY MONITOR

The Manhattan Institute’s ProxyMonitor.org database, launched in 2011, is the first publicly available database cataloging shareholder proposals and Dodd-Frank-mandated[1] executive-compensation advisory votes at America’s largest companies. This is the 28th in a series of findings and reports, drawing upon information in the database, to examine shareholder activism in which investors attempt to influence corporate management through the shareholder voting process.[2]

|

Under rules promulgated by the federal Securities and Exchange Commission, stockholders who have held at least $2,000 in a publicly traded company’s equity for at least one year can introduce nonbinding proposals on the corporation’s proxy statement, for all shareholders to consider at the company’s annual meeting.[3] In addition to labor-affiliated pension funds and investment funds with a religious, public-policy, or “social investing” purpose,[4] the most frequent sponsors of shareholder proposals are “corporate gadflies”[5]—individuals who repeatedly file common proposals, year after year, across a broad class of companies. In 2014, three corporate gadflies—John Chevedden, William Steiner, and James McRitchie—have been among the four most frequent shareholder proponents,[6] based on the filings of the 219 Fortune 250 companies to have held annual meetings to date.[7] Chevedden, Steiner (along with son, Kenneth), and McRitchie (along with wife, Myra K. Young) have introduced 70 percent of all individual-sponsored shareholder proposals this year. In general, these activists—who have a history of working together—have focused on corporate-governance-process proposals that are more likely to gain traction with voting shareholders than are proposals focusing on social or policy issues.

The motives of gadfly investors are not always clear. In their telling, they are selflessly looking out for the small investor against corporate managers who run roughshod over their interests. They may also, however, be motivated by personal pique: Chevedden, for instance, started his shareholder activism against General Motors after its subsidiary laid him off.[8] In other cases, they may be personally profiting from their activism: longtime activist Evelyn Davis earned a reported $600,000 per year selling her 20-page annual newsletter to corporate executives.[9] Finally, they may be working in concert with labor-affiliated investors with other agendas. In its 2014 proxy statement, AutoNation reports that for eight consecutive annual meetings, Chevedden’s proposal has been introduced by “a representative of the International Association of Machinists and Aerospace Workers,” which, for many years, has “been attempting to organize automotive dealership service technicians,” including AutoNation’s.[10]

This finding focuses in more detail on shareholder-proposal activity from corporate gadflies. Part I examines the role played by such investors in 2014—and over time. Part II looks at shareholder voting results on gadflies’ proposals. Part III examines, in greater depth, the types of shareholder proposals sponsored by the three leading gadflies: Chevedden, Steiner, and McRitchie. Part IV discusses recent legal challenges to gadflies’ activism, while briefly considering policy issues involved.

I . Corporate Gadflies’ Shareholder-Proposal Activism

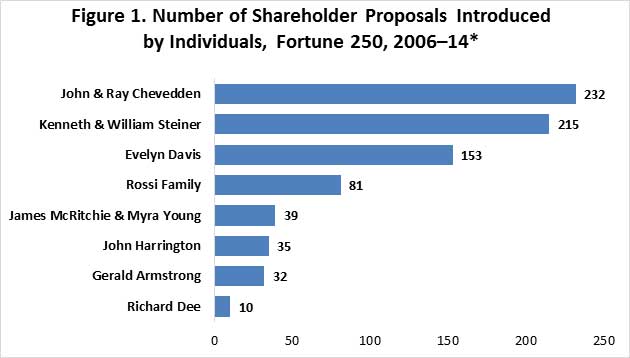

Since 2006 (the first year in the ProxyMonitor.org database), the three most frequent sponsors of shareholder proposals at Fortune 250 companies have been corporate gadflies: John Chevedden (including, in earlier years, his family trust and now-deceased father, Ray); William Steiner (and son, Kenneth); and Evelyn Davis. Over the last nine years, Chevedden has sponsored 232 proposals, Steiner 215, and Davis 153 (Figure 1). Other frequent filers over the time span include Emil Rossi (and family), James McRitchie (and wife, Myra K. Young), John Harrington, and Gerald Armstrong. These seven people (and their family members) are the only individual investors to file more than ten shareholder proposals during the 2006–14 period.

*2014 reports filed, to date, by 219 of 250 companies reporting

Source: ProxyMonitor.org

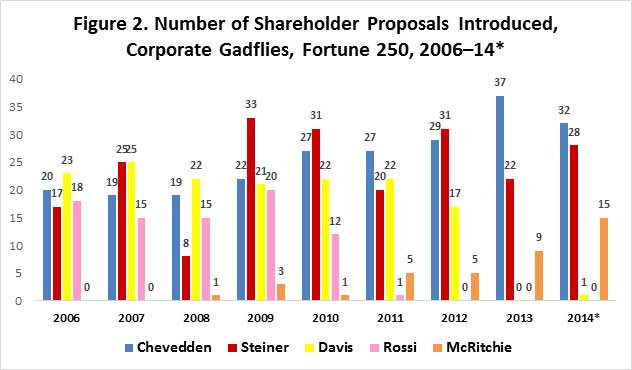

Among the five most active gadflies—Chevedden, Steiner, Davis, Rossi, and McRitchie—only Chevedden and Steiner have been active consistently during this time (Figure 2). The 68-year-old Chevedden, who earned an MBA from Pepperdine in 1984 and formerly worked scheduling parts orders for aerospace companies Allied Signals (now part of Honeywell) and Hughes Aircraft (later part of General Motors), became active in shareholder activism after he was laid off from Hughes in 1991, at the age of 45.[11] After initially filing a discrimination complaint against Hughes with the Equal Employment Opportunities Commission, Chevedden in 1994 introduced his first shareholder proposal, with GM, asking it to issue a report detailing Hughes’s employment practices.[12] Before long, Chevedden emerged as a persistent corporate gadfly, regularly introducing proposals at companies in his portfolio, which reportedly consists of holdings in roughly 100 companies, spread about in small chunks just above “the minimum amount of shares needed to be eligible to file a resolution.”[13] Chevedden filed between 19 and 22 shareholder proposals annually at Fortune 250 companies from 2006 through 2009 and has subsequently increased his participation—sponsoring 37 in 2013 and 32 to date this year.

*219 of 250 companies reporting

Source: ProxyMonitor.org

New York–based William Steiner has been dubbed Chevedden’s “East Coast counterpart”: the two investors regularly “team up,” though they have never met in person.[14] Steiner began proposing shareholder resolutions before Chevedden, in the 1980s; in more recent years, his efforts have been joined by his son, Kenneth. The Steiners’ activity has varied from a low of eight proposals sponsored in 2008, to a high of 33 in 2009, with 28 filed to date in 2014.

In contrast, two longtime corporate gadflies—octogenarians Evelyn Davis and Emil Rossi—have now largely retired from their shareholder-proposal activism. The flamboyant Davis, a Dutch-born four-time divorcée, has a career as a corporate gadfly dating to IBM’s 1959 annual meeting.[15] Davis introduced between 21 and 25 proposals annually at Fortune 250 companies from 2006 through 2011, 17 in 2012, none in 2013, and one to date in 2014.

Rossi, the Brooklyn-born son of Italian immigrants who ran a hardware store in Boonville, California, began agitating at corporations in the late 1960s because he disagreed with “the idea that corporate boards were filled with men from ‘famous’ colleges like Harvard.”[16] Rossi—along with sons Nick and Chris, as well as other family members—sponsored 15 to 20 shareholder proposals from 2006 through 2009, 12 in 2010, one in 2011, and none thereafter.

Finally, McRitchie, who blogs about corporate governance at his website Corpgov.net, has only recently emerged as a frequent sponsor of shareholder proposals. McRitchie, along with his wife, Myra K. Young, sponsored no proposals in 2006 or 2007, one to three annually from 2008 through 2010, five each in 2011 and 2012, nine in 2013, and 15 to date in 2014.

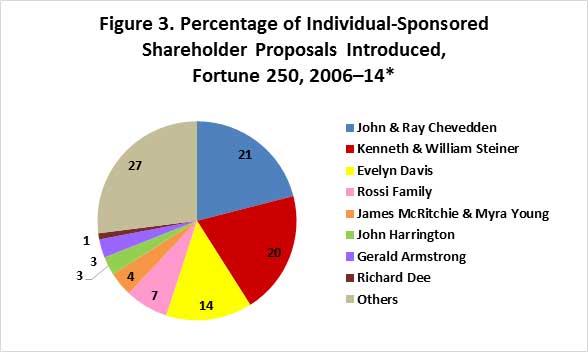

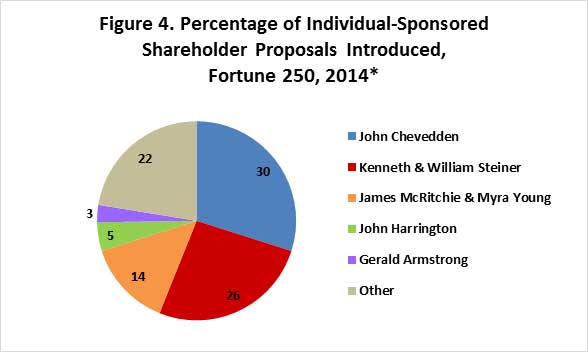

In total, from 2006 through 2014, 72 percent of all shareholder proposals sponsored by individual investors came from these seven people and their family members (Figure 3): Chevedden (21 percent), Steiner (20 percent), Davis (14 percent), Rossi (7 percent), McRitchie and Young (4 percent), Armstrong (3 percent), and Harrington (3 percent). In 2014, even with Davis and Rossi filing only one proposal between them, the percentage of individual-sponsored shareholder proposals introduced by gadflies is even higher, at 78 percent (Figure 4). Chevedden has introduced 30 percent of individual-sponsored shareholder proposals this year, the Steiners 26 percent, McRitchie and Young 14 percent, Harrington 5 percent, and Armstrong 3 percent.

*219 of 250 companies reporting

Source: ProxyMonitor.org

*219 of 250 companies reporting

Source: ProxyMonitor.org

II. Voting Results

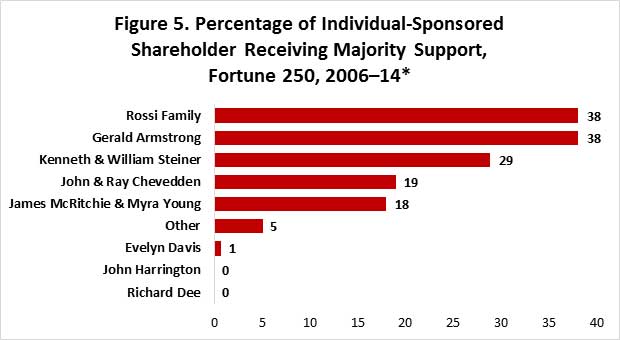

Corporate gadflies’ ability to win the support of a majority of shareholders has varied markedly. At the high end, Emil Rossi and his family members won support from a majority of shareholders at Fortune 250 companies at which they sponsored a shareholder proposal 38 percent of the time from 2006 through 2014(Figure 5). Also winning majority-shareholder support 38 percent of the time was Gerald Armstrong, a less active gadfly who has sponsored between one and six shareholder proposals in each year from 2006 through 2014.

*219 of 250 companies reporting

Source: ProxyMonitor.org

Almost all the Rossis’ successful shareholder proposals involved one of three subjects: eliminating supermajority voting provisions in corporate bylaws (empowering shareholders to act through a simple majority vote); allowing shareholders to act outside annual meetings by written consent; and allowing shareholders to call special meetings outside the annual meetings schedule. The Rossis also won majority shareholder backing for one proposal to require a shareholder vote to approve any “poison pill” designed to interfere with a prospective takeover bid; and for two proposals to “declassify” the board of directors and elect all directors annually—an idea that has generally won shareholder support, given that staggered board terms can block potential takeovers.[17] Other classes of proposals typically sponsored by the Rossis— including proposals for cumulative voting in director elections (allowing shareholders to pool all their director votes behind a single preferred candidate) and for splitting the company’s chairman and chief executive officer positions—consistently failed to win majority support.

Nine of Armstrong’s 12 shareholder proposals to win support from a majority of shareholders called for declassifying boards of directors. Armstrong also won majority support for two of four proposals seeking a shareholder advisory vote on executive compensation (now required at all publicly traded companies under Dodd-Frank) and one 2012 proposal seeking to reincorporate then-beleaguered Chesapeake Energy[18] in the state of Delaware.[19] Armstrong’s most frequently introduced proposal, calling for splitting a company’s chairman and CEO positions, consistently failed to win majority shareholder support.

At the other end of the spectrum, Evelyn Davis and John Harrington received the support of a majority of shareholders for 1 and 0 percent, respectively, of the shareholder proposals they introduced between 2006 and 2014. Almost half (76) of Davis’s proposals have pushed for cumulative voting in director elections; only one of these received the support of a majority of shareholders, a 2006 proposal at Bank of New York Mellon garnering 51.1 percent of the vote.[20] Davis also introduced proposals focused on executive compensation and—unlike most corporate gadflies—she introduced various social and policy issues, most often involving corporations’ political spending and connections.

John Harrington, unlike the other corporate gadflies, is principally a social investor,[21] who, in addition to filing shareholder proposals on his own behalf, files proposals through his social-investing fund, Harrington Investments. Of Harrington’s shareholder proposals introduced between 2006 and 2014, 25 out of 35 involved social or policy issues (chiefly concerning the environment or human rights). Harrington also sponsored four proposals related to executive compensation and six related to corporate governance concerns. On average, 93.4 percent of shareholders voted against Harrington’s proposals over this time period.

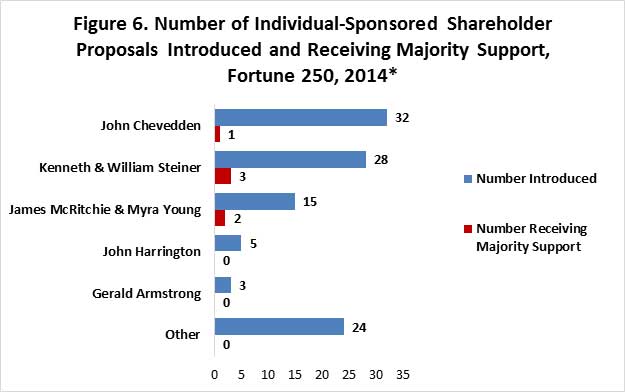

Chevedden, Steiner, and McRitchie are not only the most active in 2014, but all fall in the middle in terms of shareholder support: their proposals have won the support of a majority of shareholders 19, 29, and 18 percent of the time, respectively. These are the only individual investors to introduce proposals winning majority shareholder support this year: one for Chevedden, three for William and Kenneth Steiner, and two for McRitchie and Young (Figure 6). In each case, the percentage of proposals receiving majority support in 2014—3 percent for Chevedden, 11 percent for Steiner, and 13 percent for McRitchie—is below the gadflies’ historical norm. The next section will assess this trend while examining the types of proposals these gadflies have introduced.

*219 of 250 companies reporting

Source: ProxyMonitor.org

III. Examining Major 2014 Gadflies’ Shareholder Proposals

The decrease in support for shareholder proposals sponsored by Chevedden, Steiner, and McRitchie in 2014 parallels reduced support for shareholder proposals overall. In part, this decline is attributable to the adoption, at many larger companies, of some of the ideas that gadflies and shareholder-proposal activists have espoused, including declassifying boards of directors, eliminating supermajoity voting provisions in corporate bylaws, and requiring that directors be elected by a majority of voting shareholders. As such governance rules have been more broadly adopted, fewer companies remain at which activist investors can submit these proposals; of such remaining companies, many have ownership or stock-voting structures that make shareholder proposals opposed by the board unlikely to pass.

In addition, shareholders’ support has waned for some of the ideas commonly pushed in corporate gadflies’ proposals—especially proposals to empower shareholders to call special meetings or act outside annual meetings through written consent. After the Service Employees International Union (SEIU) introduced a special-meeting proposal that won the support of a majority of shareholders at JPMorgan Chase in 2006, gadflies like Chevedden, Steiner, and Rossi began introducing these proposals with increasing frequency. Initially, they enjoyed success, winning the support of a majority of shareholders for seven of 11 proposals introduced in 2007, eight of 20 in 2008, and 19 of 41 in 2009. Thereafter, shareholder support for such proposals slipped markedly: only eight of 36 special-meeting proposals received majority support in 2010, one of 22 in 2011, one of nine in 2012, one of seven in 2013, and three of nine in 2014.

A similar story can be told for shareholder proposals seeking to permit shareholder action by written consent—a common power at small, closely held corporations but one rarely seen at large, publicly traded companies before Chevedden, the Steiners, and Chris Rossi introduced 15 such proposals at Fortune 250 companies in 2010.[23] Initially, their efforts met with great success in attracting shareholder support: 11 of 15 written-consent proposals won majority backing in 2010. Shareholder support for these proposals subsequently fell dramatically: only nine of 27 such proposals received majority support in 2011, two of 17 in 2012, and none of the 19 proposals introduced in both 2013 and 2014, respectively.[24]

A final reason that support for corporate gadflies’ shareholder proposals has fallen in 2014 is that the focus of the two main gadflies, Chevedden and Steiner, has changed. The remainder of this section will examine these gadflies’ shareholder activism in greater detail, as well as that of a third, who has assumed increasing significance: James McRitchie.

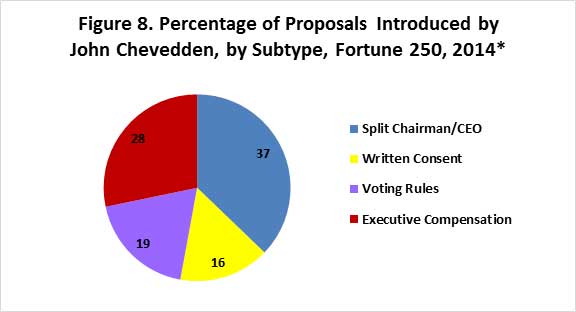

John Chevedden

From 2006 through 2014, 44 of the 232 shareholder proposals introduced at Fortune 250 companies by John Chevedden, his family trust, and his late father received the support of a majority of shareholders. Twenty-four of these involved voting rules, 12 were proposals to permit shareholders to call special meetings or act by written consent, three sought to split the company’s chairman and CEO positions, two sought to declassify the board of directors, two sought shareholder advisory votes on executive compensation, and one sought to amend the company’s rules for removing a director. Over the entire 2006–14 period, a majority of Chevedden’s proposals involved voting rules or shareholders’ ability to call special meetings or act by written consent, though he also introduced many proposals concerning executive compensation, splitting the chairman and CEO roles, and other corporate-governance issues (Figure 7). In contrast to his previous practice, however, Chevedden has focused his 2014 shareholder-proposal activism on separating the chairman and CEO positions and on executive compensation—proposals much less likely to win shareholders’ support—which constituted 65 percent of all his 2014 shareholder proposals (Figure 8). The sole Chevedden proposal to win majority support in 2014 was a “chairman independence” proposal, submitted at Staples, which received a bare majority (50.6 percent) of shareholders’ votes.

*219 of 250 companies reporting

Source: ProxyMonitor.org

*219 of 250 companies reporting

Source: ProxyMonitor.org

William and Kenneth Steiner

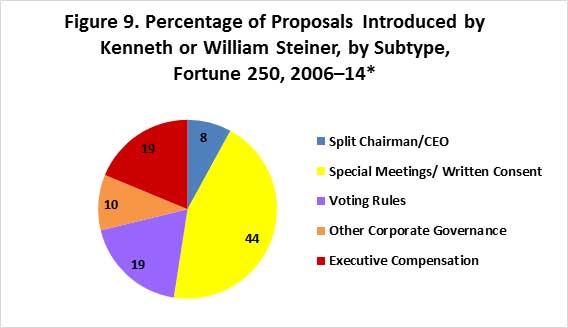

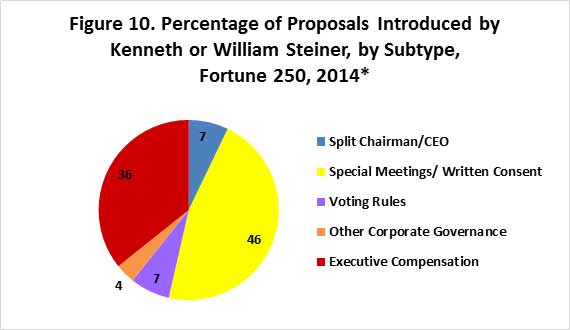

One main reason why the father-son gadfly team of William and Kenneth Steiner has seen a higher percentage of their proposals win majority shareholder support than Chevedden is that the Steiners have been far less likely to sponsor proposals related to executive compensation or those seeking to split the company’s chairman and CEO roles—proposals far less likely to win shareholders’ support. Such proposals constituted 27 percent of those sponsored by the Steiners during the full 2006–14 period (Figure 9), compared to 40 percent for Chevedden; and 43 percent of the proposals sponsored by the Steiners to date in 2014 (Figure 10), compared to 65 percent for Chevedden. The percentage of Steiner-sponsored proposals seeking to separate the chairman and CEO, permit shareholders to call special meetings, or act by written consent, is essentially unchanged in 2014 relative to historical patterns. The Steiners have, however, significantly increased their focus this year on executive-compensation concerns (which constitute 36 percent of their 2014 shareholder proposals, versus 19 percent in the full 2006–14 period); and significantly reduced their emphasis on voting rules and other corporate-governance issues (which have collectively constituted just 11 percent of their shareholder proposals in 2014, versus 29 percent in the full 2006–14 period).

*219 of 250 companies reporting

Source: ProxyMonitor.org

*219 of 250 companies reporting

Source: ProxyMonitor.org

In total, 62 of the 215 proposals introduced by the Steiners from 2006 through 2014 at Fortune 250 companies have won majority support, including: 29 seeking to give shareholders the right to call special meetings or act by written consent, 21 involving voting rules, four seeking to declassify boards of directors, four seeking to give shareholders rights to vote on change-of-control poison pills, three involving executive compensation, and one seeking to separate the chairman and CEO positions. The shareholder proposals sponsored by the Steiners that have won majority support in 2014 included two that sought to give shareholders the right to call special meetings (one, introduced by Kenneth Steiner at Applied Materials, was supported by 54.5 percent of shareholders; the other, introduced by William Steiner at PPL, was supported by 59 percent of shareholders) and one that sought to eliminate supermajority voting provisions in the company bylaws (which was introduced by Kenneth Steiner at Bristol-Myers Squibb and was supported by 80.1 percent of shareholders after the board decided to recommend neither “For” nor “Against” the proposal).[25]

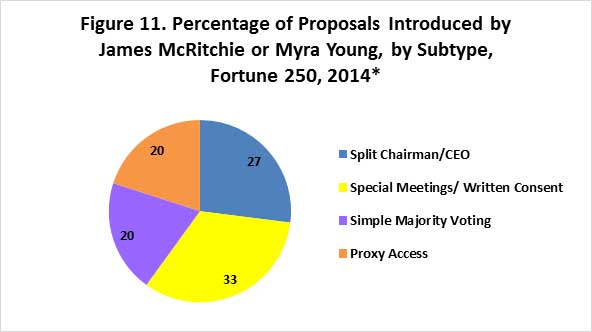

James McRitchie and Myra K. Young

The husband-and-wife team of McRitchie and Young has emerged as a significant sponsor of shareholder proposals: the 15 proposals these two sponsored at Fortune 250 companies in 2014 were more than any other shareholder save Chevedden, Steiner, and the New York State Common Retirement Fund. McRitchie and Young have focused on proposals to allow shareholders to call special meetings or act by written consent, proposals seeking to separate the chairman and CEO positions, proposals seeking to eliminate supermajority voting provisions from company bylaws, and proposals seeking to grant shareholders the right to have their own nominees for director placed on corporate proxy ballots (“proxy access” proposals)[26] (Figure 11). The two proposals sponsored by McRitchie and Young that received majority shareholder support in 2014 each sought to eliminate supermajority voting requirements, one introduced by McRitchie at Costco (receiving 65.2 percent shareholder support) and one introduced by Young at NextEra Energy (receiving 73.0 percent shareholder support).[27]

*219 of 250 companies reporting

Source: ProxyMonitor.org

IV. Challenges to Corporate Gadflies’ Activism and Policy Analysis

Corporate directors and executives have often kowtowed to corporate gadflies, in an effort to stay in their good graces. For instance, business leaders eagerly bought up copies of Evelyn Davis’s annual investor newsletter Highlights and Lowlights, paying $495 per copy—with a minimum order size of two—for the gadfly’s 20-page “eccentric, Xeroxed” document, which netted Davis a reported $600,000 per year.[28] Chevedden also gets such business leaders’ attention; for example, at last year’s DreamWorks annual meeting, “the Hollywood studio’s Chief Executive Jeffrey Katzenberg and Chairman Mellody Hobson—about to marry Star Wars creator George Lucas—walked across the room to say hello to Chevedden.”[29]

Challenges to Chevedden

In recent years, companies have been taking a more aggressive stance against some gadflies—notably, Chevedden. Companies have been significantly more likely to launch a challenge with the SEC for shareholder proposals sponsored by Chevedden than for those introduced by other sponsors: Chevedden was the sponsor of 23 of the 104 shareholder proposals excluded from corporate proxy ballots last year after the company successfully petitioned the SEC with a no-action letter under Rule 14a-8.[30]

Car retailer AutoNation has taken to responding to Chevedden aggressively in its proxy statements. In 2014, the board’s response to the gadfly stated:

Chevedden, a purported owner of no less than 100 shares, or approximately 0.0001%, of our common stock and a stockholder proponent that sends out stockholder proposals to a large number of companies every year, has been sending stockholder proposals to the Company since 2001, none of which have received a majority stockholder vote. Instead, each time one of his stockholder proposals has been presented at an Annual Meeting of AutoNation stockholders, our stockholders have soundly rejected it. Further, at each of the last eight Annual Meetings of AutoNation stockholders, rather than presenting the stockholder proposal himself, a representative of the International Association of Machinists and Aerospace Workers (the “Machinists”) presented the stockholder proposal from Mr. Chevedden on his behalf. It is not clear to us what the nature of Mr. Chevedden’s relationship is with the Machinists or what his or the Machinists’ motivations are in making stockholder proposals, but we do know that the Machinists have been attempting to organize automotive dealership service technicians, including some of ours, for many years. While we do not ascribe improper motivations to Mr. Chevedden or the Machinists, we do not believe it is appropriate to make stockholder proposals based on personal or special interests—such as a desire to organize Company employees—or grievances against the Company that are not shared by stockholders as a whole.[31]

Some companies have also taken to challenging Chevedden in court.[32] In 2010, Apache successfully sued to exclude a Chevedden proposal in federal district court in Texas, on the basis that he had failed to demonstrate that he owned the shares that he claimed to have owned continuously for a year.[33] KBR also subsequently filed suit in the same court to exclude a Chevedden proposal,[34] as did Waste Connections in objecting to a proposal filed by Chevedden on behalf of McRitchie and Young.[35] In early 2014, Express Scripts successfully sued in federal district court in Missouri to exclude a Chevedden proposal for inaccuracies.[36] Chevedden was successful, however, in defeating 2014 suits by Omnicom in New York,[37] EMC in Massachusetts (in a suit also naming McRitchie),[38] and Chipotle Mexican Grill in Colorado (in a suit also naming McRitchie and Young).[39]

Policy Analysis and Conclusion

Federal courts have therefore split on the propriety of excluding corporate gadflies’ proposals from the proxy ballot. Whatever the legal merits of the cases filed against Chevedden, the fact that large, publicly traded corporations are willing to go to the considerable legal expense of challenging the gadfly both before the SEC and in court filings—including, in some cases, in federal appeals—suggests how costly corporate boards and management can view such proposals.

The likely cost of such corporate responses stands in stark contrast to the meager shareholdings that Chevedden and other gadflies typically hold in the companies they pester. Although determining the precise holdings of small shareholders can be difficult—and is the very focus of many of the cases challenging Chevedden’s proposals—the self-reported holdings listed by Chevedden in his proposal submissions suggest that he owns a very small percentage of the companies he targets. In 2014, 24 of the 32 companies facing Chevedden proposals indicated his purported stock holdings on their proxy statements.[40] According to those filings, Chevedden’s purported ownership ranged from a low of $2,172 in Honeywell to a high of $16,433 in Lockheed Martin, with an average holding valued at $7,462.[41] In no instance could Chevedden’s ownership stake conceivably exceed the cost he imposed on the company to respond to and accommodate (or challenge) his proposal.

Chevedden’s form of shareholder activism differs markedly from that of hedge funds and large activist investors like Carl Icahn. In the latter case, the investor takes a large stake in a specific company viewed as underperforming and works to turn it around. The large activist investor’s sizable ownership in the corporation being targeted generally precludes the possibility that the investor is interested in harming the company’s overall welfare for personal gain;[42] empirical evidence, moreover, suggests that such activism, on average, accrues to the average shareholder’s benefit.[43]

That said, there is little evidence that corporate gadflies like Chevedden, the Steiners, or McRitchie have endeavored to profit personally from their shareholder-proposal activism—as did Davis by selling corporate executives her high-priced, 20-page newsletter. Rather, Chevedden and his allies seem to envision themselves as assuming costs for the benefit of the average investor. Whether those benefits actually accrue, however, is quite speculative.

To be sure, these gadflies’ proposals—unlike those of Davis or social investors—do sometimes gain majority support from shareholders. On the other hand, the proposals that these gadflies have advanced most successfully—pushing to eliminate declassified boards or to eliminate supermajority voting provisions from corporate bylaws—are also regularly advanced by labor-affiliated pension funds. The other class of proposals that gadflies have successfully pushed in recent years—those seeking to grant shareholders additional powers to call special meetings or act by written consent—have seen shareholder support wane markedly after initial success, suggesting that shareholders have generally become skeptical of these gadfly “innovations.”[44] Shareholder support for proposals introduced by other individual shareholders, apart from the gadflies, has remained anemic.[45]

Thus, the SEC would be well-advised, as it decides whether to act on a rulemaking petition seeking to increase the threshold requirements for resubmitting substantially similar shareholder proposals,[46] to also look into its overall submission standards as they apply to small shareholders. The commission’s stated purposes are protecting investors, ensuring market efficiency, and facilitating capital formation.[47] In protecting the average investor, the SEC should weigh the value afforded to investors who wish to “agitate” by submitting shareholder proposals against the prospect that such agitation imposes costs on other shareholders who are essentially unable to fight back. The fact that gadfly investors’ efforts with sustained success have existed in parallel to similar shareholder proposals sponsored by large pension funds suggests that significantly increasing the ownership thresholds for sponsoring a shareholder proposal might generate substantial value to the average shareholder, at no cost. Regardless, the commission should clarify the issues—including proof of share ownership and ability to act as a shareholder-proposal proxy on another shareholder’s behalf—that have been the subject of recent litigation involving companies and Chevedden.

ENDNOTES

- Pub. L. No. 111-203, 124 Stat. 1376, §951 (2010).

- See Proxy Monitor, Reports and Findings, http://proxymonitor.org/Forms/reports_findings.aspx (last visited July 30, 2014).

- See 17 C.F.R. § 240.14a-8 (2007) [hereinafter 14a-8]. The federal Securities and Exchange Commission determines the procedural appropriateness of a shareholder proposal for inclusion on a corporation’s proxy ballot, pursuant to the Securities Exchange Act of 1934, Pub. L. No. 73-291, Ch. 404, 48 Stat. 881 (1934) (codified at 15 U.S.C. §§ 78a–78oo (2006 & Supp. II 2009)), at §§ 78m, 78n & 78u; 15 U.S.C. §§ 80a-1 to 80a-64 (2000) (pursuant to Investment Company Act of 1940, Pub. L. No. 76-768, 54 Stat. 841 (1940)); but the substantive rights governing such measures and how they can force boards to act remain largely a question of state corporate law; cf. Del. Code Ann., tit. 8, § 211(b) (2009) (noting that in addition to the election of directors, “any other proper business may be transacted at the annual meeting”).

- “In general, socially responsible investors are looking to promote concepts and ideals that they feel strongly about”—beyond mere share value. Michael Chamberlain, Socially Responsible Investing: What You Need to Know, FORBES, Apr. 24, 2013, http://www.forbes.com/sites/feeonlyplanner/2013/04/24/socially-responsible-investing-what-you-need-to-know. Although pension plans are generally bound as fiduciaries under the Employee Retirement Income Security Act (ERISA) to “consider only those factors that relate to the economic value of the plan’s investment,” 29 C.F.R. § 2509.08-2(1) (2008) (emphasis added), those operating under the auspices of a state or municipal government, or those affiliated with religious organizations, are exempt from this requirement; see 29 U.S.C. § 1003(b).

- “Corporate gadflies,” as commonly used in Charles M. Yablon, Overcompensating: The Corporate Lawyer and Executive Pay, 92 COLUM. L. REV. 1867, 1895 (1992); and Jessica Holzer, Firms Try New Tack Against Gadflies, WALL ST. J., June 6, 2011, http://online.wsj.com/article/SB10001424052702304906004576367133865305262.html.

- The other most frequent sponsor of shareholder proposals in 2014 was a pension fund for public employees, the New York State Common Retirement Fund, which holds assets in trust for the New York State & Local Retirement System (NYSLRS).

- Twelve companies, whose annual meeting results appear in the Proxy Monitor database, were not in the Fortune 250 list for 2013 and therefore are excluded from this analysis: Aon, Ashland, Coca-Cola Enterprises, Devon Energy, Eaton, ITT, KBR, Motorola, Oshkosh, Public Service Enterprise Group, Sempra Energy, and the Williams Companies.

- See Ross Kerber, This Man Has Quietly Transformed Corporate America, BUS. INSIDER, Oct. 24, 2013, http://www.businessinsider.com/this-man-has-quietly-transformed-corporate-america-2013-10.

- Amy Feldman, Fighting the Fat Cats for Decades, Evelyn Davis Has Grilled Biz Bigwigs in Outrageous Fashion, NY DAILY NEWS, May 24, 1998, http://www.nydailynews.com/archives/news/fighting-fat-cats-decades-evelyn-davis-grilled-biz-bigwigs-outrageous-fashion-article-1.790296.

- AutoNation, Inc., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, proposal no. 5 (Mar. 24, 2014), https://www.sec.gov/Archives/edgar/data/350698/000035069814000041/a2014proxystatement.htm.

- See Kerber, supra note 8.

- See id.

- Id.

- Nathaniel Popper, Step by Step, Activist Investors Gaining Clout, SALT LAKE CITY TRIB., Sept. 4, 2010; Kerber, supra note 8.

- See Securities and Exchange Commission, Spotlight: Evelyn Davis, Editor of Highlights and Lowlights, http://www.sec.gov/spotlight/proxyprocess/bio052507/eydavis.pdf (last visited Aug. 1, 2014); Corporate Top Guns Listen to ‘Gadfly with a Fortune’, TIMES DAILY, Apr. 15, 1990.

- Corporations Feel Effects of Shareholder Activists, TOLEDO BLADE, June 13, 2004; see Patrick McGeehan, The Agenda; No Democracy on these Ballots, NY TIMES, Feb. 13, 2005; Lives and Times of Anderson County Folks: Emil Rossi, Nov. 14, 2008, http://avalleylife.wordpress.com/2008/11/17/emil-rossi-november-14th-2008.

- See Lucian A. Bebchuk, Alma Cohen, and Charles C. Y. Wang, Staggered Boards and the Wealth of Shareholders: Evidence from Two Natural Experiments (Nat’l Bureau of Econ. Research, Working Paper No. 17127, June 2011), http://www.nber.org/papers/w17127. Cross-sectional empirical studies have shown that de-staggered board structures are associated with higher shareholder returns. See, e.g., Gabriel Hawawini and Donald B. Keim, The Cross Section of Common Stock Returns: A Review of the Evidence and Some New Findings, Wharton School, University of Pennsylvania, May 14, 1998, http://knowledge.emory.edu/papers/794.pdf ; N. Theriou, P. Chatzoglou, D. Maditinos, and V. Aggelidis, The Cross-Section of Expected Stock Returns: An Empirical Study in the Athens Stock Exchange, Democritus University of Thrace, July 2003, http://abd.teikav.edu.gr/articles_th/cross-section1.pdf. More recent scholarship incorporating more sophisticated time-series analysis, however, has cast doubt on the robustness of these findings; see Martijn Cremers, Lubomir P. Litov, and Simone M. Sepe, Staggered Boards and Firm Value, Revisited, Social Science Research Network, Dec. 19, 2013, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2364165, at least as applied universally. See Stephen Bainbridge, Is the Harvard Shareholder Rights Project Attack on Staggered Boards Misguided?, Professor Bainbridge, Jan. 14, 2014, http://www.professorbainbridge.com/professorbainbridgecom/2014/01/is-the-harvard-shareholder-rights-project-attack-on-staggered-boards-misguided.html.

- In 2012, Chesapeake’s two largest shareholders—Southeastern Asset Management and billionaire activist investor Carl Icahn, who together controlled 21 percent of the company—revolted against the company’s board and management after its stock price dropped nearly 50 percent in the preceding year. See Clifford Krauss, Chesapeake Agrees to Revamp Its Board, NY TIMES, June 4, 2012, http://www.nytimes.com/2012/06/05/business/chesapeake-agrees-to-new-board.html. In response, the Oklahoma-based company—the nation’s second-largest natural gas producer after Exxon Mobil—also agreed to remove chief executive Aubrey McClendon from his chairman role, to restructure its executive-compensation package, and to modify its governance practices. See id.

- Although the SEC sets rules for publicly traded companies’ proxy ballots, shareholders’ substantive rights relative to boards of directors are generally governed by state law. See supra note 3. Delaware’s specialized business courts, which date to 1792, tend to be preferred by managers and shareholders alike: a majority of all publicly traded companies, and over 60 percent of those in the Fortune 500, are incorporated in the state. See James R. Copland, Lawyers Descend on Delaware to Kill Shareholder “Tax” Relief, INVESTOR’S BUS. DAILY, June 18, 2014, http://www.manhattan-institute.org/html/miarticle.htm?id=10445.

- After the bank failed to implement the proposal, Davis continued to introduce it, but shareholder support fell, to 37.7 percent in 2007, 38.0 percent in 2008, 36.1 percent in 2009, 36.1 percent in 2010, 30.2 percent in 2011, and 26.4 percent in 2012.

- See Chamberlain, supra note 4.

- Harrington Investments describes itself as “a leader in Socially Responsible Investing and Shareholder Advocacy since 1982 ... dedicated to managing portfolios for individuals, foundations, non-profits, and family trusts to maximize financial, social and environmental performance.” Harrington Investments, Inc., About Us, http://harringtoninvestments.com/about-us (last visited Aug. 1, 2014).

- That Chevedden, the Steiners, and Rossi each began introducing written-consent proposals in 2010—after never having introduced them from 2006 through 2009—suggests a degree of coordination among these corporate gadflies. As of 2010, “only approximately 28% of the Fortune 500 and 31% of public companies permit[ted] shareholders to act by less than unanimous written consent.” Ethan Klingsberg et al., Action by Written Consent: A New Focus for Shareholder Activism, Harvard Law School Forum on Corporate Governance and Financial Regulation (posted by Scott Hirst, July 5, 2010), http://blogs.law.harvard.edu/corpgov/2010/07/05/action-by-written-consent-a-new-focus-for-shareholder-activism.

- Although being able to act by written consent may have initially appealed, on its face, to shareholders, they may have subsequently become concerned that certain shareholders might be able to use this device to act “with little or no advance notice to the company or the market—and before the board has a meaningful opportunity to communicate its views regarding the proposed shareholder action.” See id. (“At a company with a concentrated shareholder base and organizational documents that include no procedural safeguards, an opening may exist for shareholders to approve actions by consent that would result in a change of control at the board level, all without advance notice to the board or other shareholders”).

- The Bristol-Myers board reasoned: “Our Board believes that generally, our governing documents should not contain supermajority voting provisions. At our 2010 Annual Meeting, the Board, in its continuing review of corporate governance best practices and after careful consideration, asked our stockholders to approve amendments to our Amended and Restated Certificate of Incorporation to remove all of the supermajority voting requirements remaining in our Certificate. These requirements consisted of a provision applicable to our common stockholders that required a vote of at least 75% of the holders of our outstanding stock to eliminate the annual election of directors and approve a classified Board structure, as well as two provisions applicable to our preferred stockholders that require a two-thirds vote of preferred stock on any proposed amendments to the Certificate or by-laws that would materially alter the existing provisions or powers, preferences or rights of the preferred stock. The proposal to remove the 75% supermajority voting provision applicable to common stockholders referenced in the above proposal and the prior paragraph was approved, and we made the applicable state filings to remove this provision from our Certificate. However, the proposal to remove the supermajority voting provisions applicable to preferred stockholders was not approved because less than two-thirds of the outstanding preferred shares voted in favor of the proposal as required by our Amended and Restated Certificate of Incorporation. In view of the stockholder vote in 2010, the Board has decided not to take a position for or against the stockholder resolution this year so it can better assess stockholder interest in this issue. Our By laws do not have any supermajority voting provisions.” Bristol-Myers Squibb Company, Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, proposal no. 4 (Mar. 19, 2014), https://www.sec.gov/Archives/edgar/data/14272/000104746914002630/a2219050zdef14a.htm#ea72601_item_4_#151;stockholde__ea702044.

- The SEC had earlier adopted a mandatory rule permitting shareholders proxy access for director nominees, but this rule was abrogated by a decision of the D.C. Circuit Court of Appeals. See Business Roundtable & Chamber of Commerce of the U.S. v. SEC, 647 F.3d 1144, 1148 (D.C. Cir. 2011), http://www.cadc.uscourts.gov/internet/opinions.nsf/89BE4D084BA5EBDA852578D5004FBBBE/$file/10-1305-1320103.pdf.

- Demonstrating the degree of coordination among certain corporate gadflies, Young’s proposal for eliminating supermajority voting rules at NextEra Energy specified that John Chevedden would be presenting the proposal at the annual meeting. See NextEra Energy, Inc., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, proposal no. 4 (Apr. 7, 2014), https://www.sec.gov/Archives/edgar/data/753308/000119312514131759/d657058ddef14a.htm#toc657058_7.

- See Feldman, supra note 9.

- See Kerber, supra note 8.

- See 14a-8, supra note 3. The shareholder proponents with the second-most successful 14a-8 challenges in 2013 were the Steiners, with seven. Data on file with Proxy Monitor.

- See AutoNation, Inc., supra note 10.

- See, generally, Andrew Ackerman, Corporations Take Swats at a Gadfly, WALL ST. J., Mar. 12, 2014.

- See Apache Corp. v. Chevedden, 696 F.Supp.2d 723 (S.D. Tex. 2010). The court ruled that Chevedden’s initial offered proof was untimely and rejected subsequent submissions as untimely. See id. at 741.

- See KBR, Inc. v. Chevedden, 478 Fed. Appx. 213 (5th Cir. 2012) (summary order).

- See Waste Connections, Inc. v. Chevedden, No. 13–00176 (S.D. Tex. 2013), aff’d No. 13-20336 (5th Cir. 2013) (summary order), http://www.gpo.gov/fdsys/pkg/USCOURTS-ca5-13-20336/pdf/USCOURTS-ca5-13-20336-0.pdf.

- See Express Scripts Holding Co. v. Chevedden, No. 13–2520, 2014 WL 631538 (Feb. 18, 2014).

- See Omnicom Group, Inc. v. Chevedden, No. 14–00386, 2014 WL (Mar. 11, 2014) (holding that Omnicom lacked Article III standing because Chevedden had agreed not to sue and the prospect of SEC enforcement action was remote).

- See EMC Corp. v. Chevedden, No. 14–10233, 2014 WL 1004111 (Mar. 16, 2014) (holding that EMC lacked Article III standing because it would not suffer “irreparable harm” from including Chevedden’s proposal on its ballot).

- See Chipotle Mexican Grill, Inc. v. Chevedden, No. 14–00018 (Mar. 14, 2014) (dismissing for lack of jurisdiction).

- In some cases, the proxy ballot merely said that he held “at least” a specified number of shares—though often with single-digit specificity.

- Chevedden’s percentage ownership varied from a low of 0.000003 percent of Honeywell to a high of 0.00008 percent of AutoNation. Data on file with Proxy Monitor.

- A possible exception, in the 1980s, was the practice of “greenmail,” in which an activist investor would acquire a large stake in a company and then accept an offer by the corporation for shares, at a premium to the regular market price. Some scholars argued that notwithstanding the premium price, greenmail tactics might create shareholder value on average. See, e.g., Jonathan R. Macey & Fred S. McChesney, A Theoretical Analysis of Corporate Greenmail, 95 YALE L.J. 13 (1985); Fred S. McChesney, Transaction Costs and Corporate Greenmail: Theory, Empirics, and a Mickey Mouse Case Study, 14 MANAGERIAL & DECISION ECON. 131 (1993). In any event, federal tax penalties adopted in 1987 made this practice largely cost-ineffective. See Stephen Bainbridge, The Return of Greenmail: Private Rent-Seeking by Activist Investors, Professor Bainbridge, June 12, 2014, http://www.professorbainbridge.com/professorbainbridgecom/2014/06/the-return-of-greenmail-private-rent-seeking-by-activist-shareholders.html.

- See, e.g., Lucian A. Bebchuk et al., The Long-Term Effects of Hedge Fund Activism, Columbia Business School Research Paper No. 13-66, July 9, 2013 (forthcoming, Columbia Law Review), http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2291577.

- As noted previously, a proposal seeking to expand shareholder rights to call special meetings was successfully introduced by the pension fund for the SEIU in 2006, before being adopted by the gadflies. The gadflies Chevedden, Chris Rossi, and William and Kenneth Steiner first introduced the written-consent proposal in 2010.

- Other individual investors—such as Icahn and Neva Rockefeller Goodwin—have very different strategies from the gadflies and, in many instances, much larger holdings in the companies they target.

- SEC, Petition for Rulemaking Regarding Resubmission of Shareholder Proposals Failing to Elicit Meaningful Shareholder Support (2014), http://www.sec.gov/rules/petitions/2014/petn4-675.pdf. The SEC currently requires companies to permit shareholders to resubmit substantially similar shareholder proposals on proxy ballots if such proposals have received a minimum 3 percent, 6 percent, or 10 percent vote, excluding abstentions, in the first, second, and third years of such proposals’ introduction; see Amendments to Rules on Shareholder Proposals, Exchange Act Release No. 40,018; 63 Fed. Reg. 29,106, 29,108 (May 28, 1998) (codified at 17 C.F.R. pt. 240), http://www.sec.gov/rules/final/34-40018.htm#foot9 (“If the proposal deals with substantially the same subject matter as another proposal or proposals that has or have been previously included in the company's proxy materials within the preceding 5 calendar years, a company may exclude it from its proxy materials for any meeting held within 3 calendar years of the last time it was included if the proposal received: (i) Less than 3% of the vote if proposed once within the preceding 5 calendar years; (ii) Less than 6% of the vote on its last submission to shareholders if proposed twice previously within the preceding 5 calendar years; or (iii) Less than 10% of the vote on its last submission to shareholders if proposed three times or more previously within the preceding 5 calendar years”).

- See What We Do, U.S. SEC. & EXCH. COMM’N, http://www.sec.gov/about/whatwedo.shtml (“The mission of the U.S. Securities and Exchange Commission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation”) (last visited Feb. 26, 2013). See 15 U.S.C. § 78c(f) (“Whenever pursuant to this title the Commission is engaged in rulemaking, or in the review of a rule of a self-regulatory organization, and is required to consider or determine whether an action is necessary or appropriate in the public interest, the Commission shall also consider, in addition to the protection of investors, whether the action will promote efficiency, competition, and capital formation”).