PROXY MONITOR 2013

FINDING 2

2013 Proxy Season Under Way

JPMorgan Chase chairman vote looms large in busy May proxy season.

PRESS RELEASE

ABOUT PROXY MONITOR

The Manhattan Institute’s ProxyMonitor.org database, launched in 2011, is the first publicly available database cataloging shareholder proposals and Dodd-Frank-mandated[1] executive-compensation advisory votes at America’s largest companies. This is the 18th in a series of findings and reports drawing upon information in the database, each of which examines shareholder activism in which investors attempt to influence corporate management through the shareholder voting process.[2]

|

Corporate America’s proxy season is now in full swing: 175 of America’s 250 largest publicly traded companies had filed proxy documents by May 3 with the federal Securities and Exchange Commission; 72 of these had held annual meetings by the end of April, and 100 of the remaining 103 face shareholder proposals or executive-compensation advisory votes at meetings scheduled between May 1 and May 23. While determining trends in voting results requires caution, given the number of companies yet to report, the broad swath of companies filing proxy statements paints a fairly clear picture of what to expect and what to watch for in the 2013 proxy season.

Looming large on the horizon is JPMorgan Chase’s May 21 annual meeting, in which shareholders will consider a proposal sponsored by the pension fund of the American Federation of State, County, and Municipal Employees (AFSCME)—as well as cosponsors including the New York City pensions—to separate the firm’s chairman and CEO positions. The vote will be a test of the strength of union pension funds and proxy advisory firms: union-fund activists

have invested heavily in the proposal, which the market may read as a referendum on the leadership of incumbent chairman and CEO Jamie Dimon;[3] and the two largest proxy advisers, Institutional Shareholder Services (ISS) and Glass Lewis, have both recommended that shareholders support the proposal.[4]

Part I of this finding summarizes proxy filings to date. Part II discusses major votes held through April. Part III looks at key votes to watch out for in May.

I. 2013 Shareholder Proposal Trends

Among the 175 Fortune 250 public companies that have filed statements with the SEC in 2013, the average company has faced only 1.10 shareholder proposals, down from 1.21 in 2012 and 1.18 in 2011. As with the early 2013 results that showed more shareholder proposals introduced in 2013,[5] this trend may be a result of sample bias—i.e., companies yet to file proxy statements with the SEC may report more proposals. If this trend continues, however, the rate of shareholder proposal introduction in 2013 would be the lowest in any year in the Proxy Monitor database, dating back to 2006. Regardless of whether the final 75 companies’ proxy statements affect overall shareholder proposal filing statistics, the number of shareholder proposals filed in 2013 should remain safely below levels seen from 2006 through 2010, when the Dodd-Frank Act mandated regular shareholder advisory votes on executive compensation, beginning with the 2011 proxy season;[6] such advisory referenda had been frequently sought in shareholder proposals in earlier years.

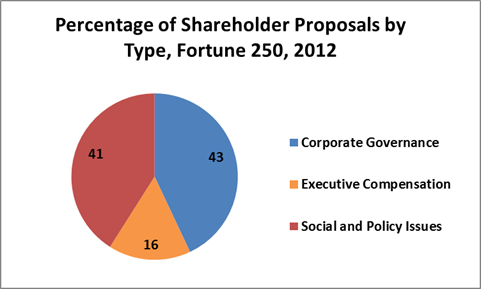

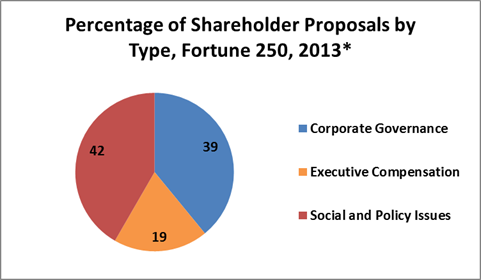

Shareholder Proposal Types, 2013

The apparent drop in shareholder proposal filings in 2013 stems largely from a decline in the number of proposals related to corporate-governance procedures, which constituted 43 percent of all proposals in 2012 but only 39 percent thus far in 2013. Conversely, the share of proposals related to executive compensation, as well as to social and policy issues, has increased marginally.

*To date, 175 of 250 companies have filed.

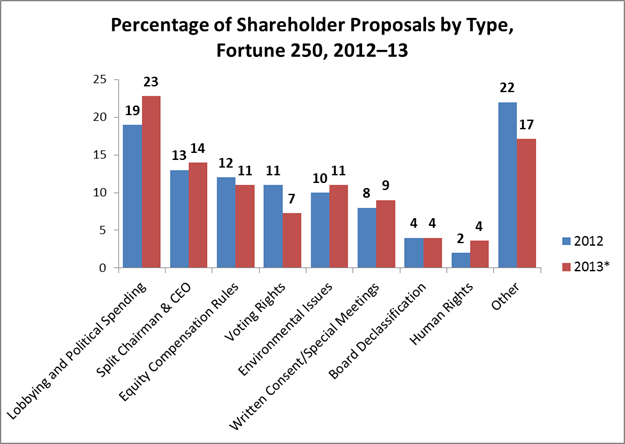

In keeping with 2012, a plurality of proposals in 2013 involves corporate political spending or lobbying—up to 23 percent, from 19 percent last year. In contrast to 2012, however, a majority of such proposals this year involve lobbying. Among Fortune 250 companies, only 11 of the 44 proposals involving corporate political spending or lobbying follow the “Political Disclosure and Oversight” template promulgated by the Center for Political Accountability (CPA),[7] a corporate-spending watchdog headed by former Democratic congressional staffer Bruce Freed. Other proposals include those seeking to prohibit corporate political spending and two new classes of proposal: one calling for board oversight of political spending, introduced at Aetna by the Unitarian Universalist Association; and one calling for a “report on corporate values and political contributions,” introduced at four companies by the social-investing fund Northstar Asset Management.

Who Is Backing Political Spending Proposals?

CPA-style political-spending-disclosure proposals have been introduced by the New York State Common Retirement Fund and the social-investing funds Trillium Asset Management, Harrington Investments, and Clean Yield Asset Management. Harrington and Clean Yield have also introduced proposals seeking to prohibit corporate political spending. Lobbying-related proposals were introduced by the New York State fund, the American Federation of Labor–Congress of Industrial Organizations (AFL-CIO), and the American Federation of State, County, and Municipal Employees (AFSCME), in addition to a small number of social-investing funds, Catholic orders, and individuals.[8] |

Although the share of corporate-governance-related proposals has fallen overall, certain classes of proposal—including those seeking to separate a company’s chairman and CEO position and those seeking to empower shareholders to call special meetings or act by written consent—have been introduced with somewhat greater frequency in 2013, relative to 2012. Proposals seeking to elect all directors annually (i.e., to “declassify” staggered boards of directors) have constituted 4 percent of proposals in 2013, in line with 2012; although public-employee pension funds affiliated with Harvard law professor Lucian Bebchuk’s Shareholder Rights Project have pushed such proposals somewhat aggressively in 2013,[9] their overall numbers remain small, in part because staggered boards are relatively rare today among the largest publicly traded corporations. Relatively fewer proposals seeking to modify shareholder voting rights have been introduced in 2013—the share of such proposals fell to 7 percent, from 11 percent in 2012—because majority voting for directors has become more common at large publicly traded companies and because octogenarian Evelyn Davis, a regular sponsor of proposals seeking “cumulative voting” for directors, has not been active in the 2013 proxy season. (Davis is a well-known “corporate gadfly,” a term commonly used to refer to a small number of individual investors who repeatedly file similar shareholder proposals at many companies.[10])

*To date, 175 of 250 companies have filed.

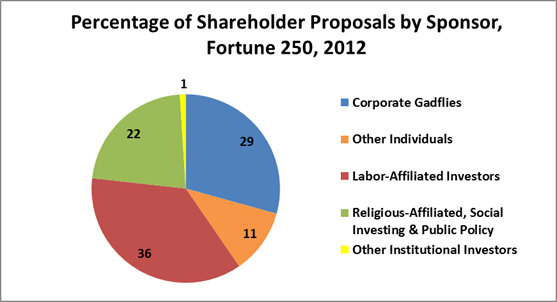

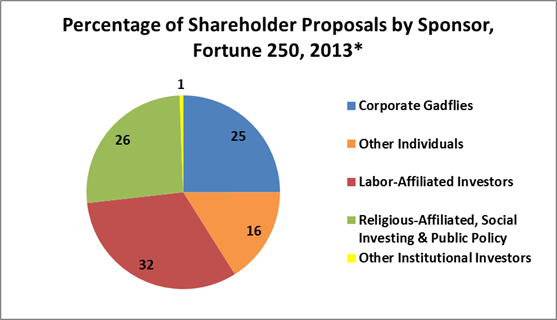

Shareholder Proposal Sponsors, 2013

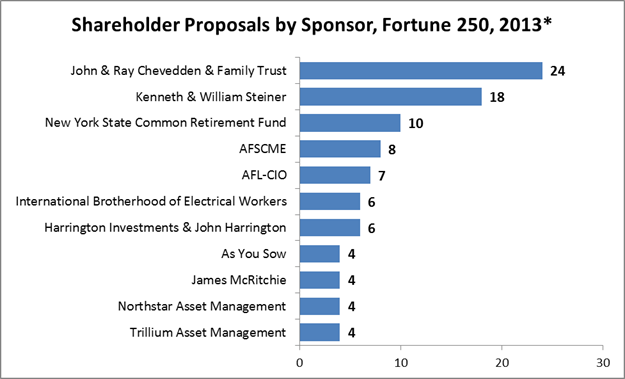

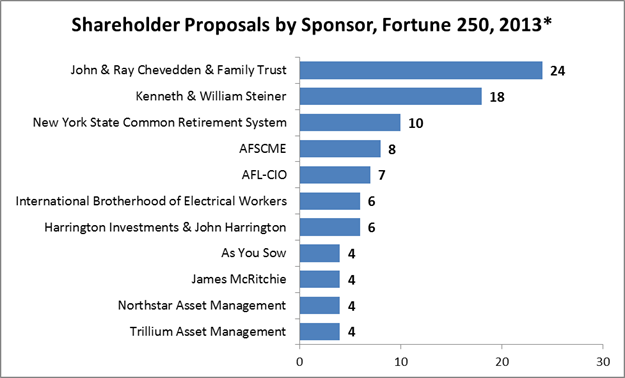

Without Ms. Davis on the scene, the percentage of shareholder proposals sponsored by corporate gadflies has fallen from 29 percent in 2012 to 25 percent this year. This 25 percent total includes only two investors and their relatives—John and Ray Chevedden and their family trust; and Kenneth and William Steiner—but 37 percent of all other individual-backed shareholder proposals came from other investors who might be dubbed gadflies, including Gerald Armstrong, James McRitchie, and social investor John Harrington. (This share is unchanged from 2012.)

*To date, 175 of 250 companies have filed.

While the Cheveddens and Steiners have filed the greatest number of shareholder proposals in 2013, labor-affiliated investors, primarily employee pension funds, constitute the most significant class of shareholder proponent, as in 2012. The third-, fourth-, fifth-, and sixth-most-regular sponsors of shareholder proposals in 2013 are the New York State Common Retirement Fund, AFSCME, the AFL-CIO, and the International Brotherhood of Electrical Workers. Overall, however, the share of labor-backed proposals this year has dropped, from 36 percent to 32 percent.

The percentage of shareholder proposals sponsored by investment funds with a “social investing” purpose, a public-policy orientation, or a religious affiliation has gone up from 22 percent in 2012 to 26 percent in 2012. The most active social-investing funds have been Northstar, Trillium, As You Sow, and Harrington Investments. In addition, eight Catholic orders of nuns or monks introduced 11 total shareholder proposals in 2013, up from only three in all of 2012.

*To date, 175 of 250 companies have filed.

II. Summary of Voting Results

In April, five shareholder proposals received majority-shareholder backing at Fortune 250 companies: two seeking board declassification at Kellogg (4/26, 52 percent support) and U.S. Steel (4/30, 81 percent); and three seeking majority-voting standards for director elections at Public Service Enterprise Group (4/15, 62 percent), PPG Industries (4/18, 78 percent), and Ameriprise Financial (4/24, 86 percent). In total, eight proposals of 87 voted on through the end of April have received majority support, five seeking board declassification (of six such proposals introduced) and three (of four) seeking majority-voting requirements to elect directors. (An additional proposal to declassify the board at Huntsman Corporation, proposed by the Florida State Board of Administration, received 59 percent support at the company’s May 2 meeting; and a proxy-access proposal at Verizon, proposed individually by C. William Jones, president of the Association of BellTel Retirees, received 53 percent support at the company’s meeting on May 3.)

Political Spending

In April, 15 companies in the Fortune 250 faced shareholder votes on political spending or lobbying proposals. In keeping with historical results, none of these received majority-shareholder support, the highest vote total being a lobbying-disclosure proposal receiving 37 percent support at Marathon Oil’s April 24 meeting. On average, the 17 shareholder proposals involving political spending or lobbying in the Proxy Monitor database have received 18 percent support to date—identical to support levels in 2012. Ten lobbying proposals received 22 percent support, up slightly from 21 percent in 2013. CPA-style political-spending-disclosure proposals received an average 23 percent support, in keeping with last year’s results, albeit with only two companies facing votes on such proposals to date.

Separating Chairman and CEO

In April, 15 large companies faced proposals to separate their chairman and CEO. While none received the support of a majority of shareholders, three did receive over 40 percent support: proposals at Honeywell (4/22, 43 percent support), Boeing (4/29, 42 percent), and IBM (4/30, 44 percent). Among the 18 Fortune 250 companies facing such proposals to date in 2013, shareholder support has averaged 27 percent, down from a 34 percent average last year.

Proxy Access

No company in April faced a proxy-access proposal, but a reported 53 percent of shareholders supported the proxy-access proposal considered by Verizon’s shareholders at its May 2 meeting. This proposal, like the one that the SEC previously adopted, before being overruled by the D.C. Circuit, would allow owners of 3 percent of the company’s shares who had held their stock for a minimum of three years to nominate their own directors on the company’s proxy ballot. At its May 8 meeting, Bank of America faced a proxy-access proposal by social investor John Harrington, which called for lower thresholds of 1 percent ownership and a two-year holding period.[11] Harrington’s proposal only received the support of 9 percent of shareholders.

Say on Pay

Since Navistar’s shareholders voted against its executive-compensation plan in February, no Fortune 250 company has seen a majority of its shareholders vote against its pay package. In April, four companies got the support of more than 50 percent but under 70 percent of shareholders: Goodyear (4/15, 56 percent support), eBay (4/18, 60 percent), Humana (4/25, 65 percent), and U.S. Steel (4/30, 64 percent). The proxy advisory firm Institutional Shareholder Services (ISS) recommended a vote against the pay package at each of these companies; Goodyear, Humana, and U.S. Steel each made additional filings discussing their executive-compensation approaches and disputing ISS’s characterization.[12]

Occidental Petroleum Director Vote

At its May 3 annual meeting, Occidental Petroleum (OXY) faced a contested executive-compensation advisory vote, a proposal from John Chevedden seeking to permit shareholder action by written consent—and a challenge to the directorship of executive chairman Ray Irani and an Irani ally, independent director Aziz Syriani. Occidental’s pay narrowly won the backing of shareholders, receiving 58 percent support, and Chevedden’s proposal narrowly failed, winning the backing of just under 49 percent of present and voting shareholders. Shareholders decisively voted out Irani, casting 76 percent of votes in opposition to his nomination; Syriani resigned his directorship the day before the meeting.[13]

A longtime Occidental executive, the 78-year-old Irani became chairman and CEO of Occidental’s chemical business in 1983 and the overall company in 1990, and built Occidental into the fourth-largest U.S. oil-and-gas company.[14] He was also paid handsomely—some 1.1 billion in compensation from 1994 through 2012—and ousted from his CEO role two years ago, in response to shareholder concerns about his pay.[15]

Occidental investors were apparently spooked by reports that Irani had attempted to oust his successor, Steven Chazen.[16] The proxy advisory firms ISS and Glass Lewis each recommended votes against Irani and Occidental’s executive-compensation package, and the company filed responses,[17] which included cuts in director pay, the future appointment of an independent director as chairman, a succession plan, and various changes to the company’s corporate governance and executive-compensation practices.

III. What to Watch For

Among the more than 100 shareholder proposals facing Fortune 250 companies in May are several related to three of the four issues flagged as “ones to watch” in the Proxy Monitor 2013 Winter Report:[18] political spending and lobbying, separating the chairman and CEO, and proxy access. There are no pending board-declassification proposals at Fortune 250 companies, subsequent to Huntsman’s May 2 meeting.

Political Spending

In the latter part of May, the following four companies face CPA-style shareholder proposals seeking political-spending disclosure:

- Anadarko Petroleum (5/14);

- WellPoint (5/15);

- Hess (5/16); and

- The Travelers Companies (5/22).

Two of these proposals were sponsored by the New York State Common Retirement Fund, and one each by the social-investing funds Trillium Asset Management and Harrington Investments.

In addition, six companies face lobbying-disclosure proposals:

- ConocoPhillips (5/14);

- Northrop Grumman (5/15);

- Altria (5/16);

- Union Pacific (5/16);

- Allstate (5/21); and

- JPMorgan Chase (5/21).

Three of these proposals were sponsored by Catholic orders of nuns or monks, and one each by AFSCME and the AFL-CIO.

At its May 14 annual meeting, 3M faces a shareholder proposal seeking to prohibit its use of corporate funds for political purposes, sponsored by the social-investing fund Clean Yield Asset Management.

Separating the Chairman and CEO

Seven companies face upcoming votes on shareholder proposals asking the board to appoint an “independent chairman” separate from the company’s CEO:

- Cummins (5/14);

- Northrop Grumman (5/15);

- Hess (5/16);

- Kohl’s (5/16);

- Aetna (5/17);

- JPMorgan Chase (5/21); and

- Xcel Energy (5/22).

Three of these proposals were introduced by John Chevedden, one by Gerald Armstrong, and one each by AFSCME, the New York City pension funds, and the Indiana Laborers Pension Fund.

As noted, much investor focus will fall on JPMorgan Chase’s vote, which sets up as a test of the company’s leadership and the strength of union pension funds and proxy advisers. Proponents of the push to strip JPMorgan chairman and CEO Jamie Dimon of his dual role have pointed to the firm’s well-publicized $6.2 billion London trading loss, incurred in 2012, as justification for their effort.[19] Although that loss had been disclosed prior to last year’s annual meeting, when 60 percent of shareholders rebuffed a similar proposal, its size and scope were not fully documented, and the union-fund shareholder activists and others supporting this effort are focusing on subsequent investigations, including a critical Senate Subcommittee report released this March,[20] in making a renewed push. The effort has generated significant press attention,[21] and some activists have used incendiary rhetoric: one AFSCME representative labeled the financial giant as “the Lindsay Lohan of banks.”[22] JPMorgan stock has appreciated 42.25 percent since the beginning of 2012, ahead of competitor Wells Fargo but behind Bank of America and Citigroup—though, since Dimon assumed the joint chairman and CEO role on December 31, 2006, JPMorgan’s shares are up 4 percent, while Bank of America’s stock has fallen over 75 percent and Citi’s over 91 percent during the same time span. (Wells Fargo’s shares have risen 8 percent over that period.) The two largest proxy advisory firms have each supported the

Independent Chairman proposal, as they did in 2012. ISS has also recommended voting against three incumbent JPMorgan directors, and Glass Lewis has recommended votes against six current members of the board.[23]

Proxy Access

CenturyLink, at its May 22 meeting, faces a proxy-access proposal introduced by individual investors Hazel A. Floyd and Mary Ann Neuman. The Floyd-Neuman proposal tracks the SEC’s former proxy-access rule, with threshold ownership requirements of 3 percent of a company’s shares held for at least three years.[24]

Proxy Fight at Hess

At its May 16 meeting, Hess Corporation faces a proxy fight with the hedge fund Elliott Associates, which is seeking to elect its own slate of alternative directors.[25] Elliott, which owns over $800 million in Hess’s common stock, seeks to improve the performance of the company, which it claims has been underperforming. Because Elliott’s proxy solicitation has supported all shareholder proposals—including one seeking to separate the company’s chairman and CEO and one seeking CPA-style political-spending disclosure[26]—its efforts are likely to influence proposal voting totals at this meeting, whether or not its proxy fight is itself ultimately successful.

Margaret M. O’Keefe, project manager for the Manhattan Institute’s Proxy Monitor effort, assisted in the preparation of this report.

ENDNOTES

- Pub. L. No. 111-203, 124 Stat. 1376, §951 (2010) [hereinafter Dodd-Frank Act].

- See Proxy Monitor, Reports and Findings, http://www.proxymonitor.org/Forms/reports_findings.aspx (last visited May 9, 2013).

- Eleazar D. Melendez, JPMorgan Activist Shareholders Bemoan 'Lindsay Lohan Of Banks', Huff Post (May 3, 2013) available at http://www.huffingtonpost.com/2013/05/03/jpmorgan-activist-shareholders_n_3211421.html.

- Dan Fitzpatrick & Joann S. Lublin, Dimon Looks to Keep Reins: J.P. Morgan Chief Wants to Retain Chairman, CEO Posts as Calls for Split Grow, Wall St. J. (May 7, 2013) available at http://online.wsj.com/article/SB10001424127887323826804578468550506200288.html; Dan McCrum & Tom Braithwaite, Proxy firm Glass Lewis calls on Jamie Dimon to drop chairman role, Fin. Times (May 7, 2013) available at http://www.ft.com/cms/s/0/12d1234a-b718-11e2-a249-00144feabdc0.html#axzz2Sp1RIofU.

- James R. Copland, Watching the 2013 Proxy Season: Union Funds Pushing Companies to Separate Chairman and CEO Roles (Manhattan Inst. for Pol’y Res., Spring 2013), http://www.proxymonitor.org/Forms/2013Finding1.aspx.

- Dodd-Frank Act, supra note 1.

- Center for Political Accountability, Political Disclosure and Oversight Resolution 2013, http://www.politicalaccountability.net/index.php?ht=d/sp/i/867/pid/867 (last visited May 9, 2013).

- While labor pension funds have aggressively pursued “transparency” in the companies in which they invest, they have not generally been transparent in their own dealings. See, e.g., Editorial, The Corporate Lobbying Proxy War: SEC chief Mary Jo White faces her first test of political independence, Wall St. J. (Apr. 28, 2013) available at http://online.wsj.com/article/SB10001424127887323809304578430991458829304.html (“Take the liberal outfit, Citizens for Responsibility and Ethics in Washington (Crew), which has been resisting an effort to subpoena its donor information.”).

- See SRP-Represented Investors, Shareholder Rights Project, http://srp.law.harvard.edu/clients.shtml (last visited May 9, 2013).

- “Corporate gadflies,” as commonly used in Charles M. Yablon, Overcompensating: The Corporate Lawyer and Executive Pay, 92 Colum. L. Rev. 1867, 1895 (1992); see also Jessica Holzer, Firms Try New Tack against Gadflies, Wall. St. J. (June 6, 2011), http://online.wsj.com/article/SB10001424052702304906004576367133865305262.html.

- See Bank of America Corp., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, proposal 5 (Mar. 28, 2013), available at http://www.sec.gov/Archives/edgar/data/70858/000119312513131136/d468848ddef14a.htm#toc468848_35.

- See The Goodyear Tire & Rubber Co., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, Say on Pay Proposal (Apr. 5, 2013), available at http://www.sec.gov/Archives/edgar/data/42582/000119312513143217/d516783ddefa14a.htm; Humana Inc., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, Definitive Additional Materials (Mar. 29, 2013), available at http://www.sec.gov/Archives/edgar/data/49071/000004907113000050/humanadefa14a32913.htm; U.S. Steel Corp., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, Definitive Additional Materials (Apr. 15, 2013), available at http://www.sec.gov/Archives/edgar/data/1163302/000119312513154324/d521638ddefa14a.htm.

- See Tom Fowler & Joann S. Lublin, Investors Push Out Oil Boss, Wall St. J. (May 4, 2014) available at http://online.wsj.com/article/SB10001424127887324582004578461130709128900.html?mod=djemalertNEWS.

- See id.

- See id.

- See id.

- Occidental Petroleum Corp., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, Definitive Additional Materials: OxyNews Release (Apr. 29, 2013) available at http://www.sec.gov/Archives/edgar/data/797468/000079746813000034/defa14a-20130429b.htm; Occidental Petroleum Corp., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, Definitive Additional Materials: OxyNews Release (Apr. 29, 2013) available at http://www.sec.gov/Archives/edgar/data/797468/000079746813000030/defa14a-20130429.htm.

- Copland, Political Spending, Say on Pay, and Other Key Issues to Watch in the 2013 Proxy Season (Manhattan Inst. for Pol’y Res., Winter 2013), http://www.proxymonitor.org/Forms/pmr_05.aspx.

- See Melendez, supra note 3.

- See U.S. Senate Permanent Subcommittee on Investigations, JPMorgan Chase Whale Trades: A Case History of Derivatives Risk And Abuses, Staff Report (Mar. 15, 2013) available at https://www.documentcloud.org/documents/618214-senate-panels-report-on-jpmorgans-trading-loss.html.

- See Charles Gasparino, All-out war to shut up Jamie Dimon, N.Y. Post (May 8, 2013) available at http://www.nypost.com/p/news/opinion/opedcolumnists/all_out_war_to_shut_up_jamie_dimon_qFllxzykcLL3DmUumO4xNK; Ross Kerber, Pension funds look to strip JPMorgan CEO Dimon of chairman title, Reuters (Feb 20, 2013) available at http://www.reuters.com/article/2013/02/20/us-jpmorgan-chase-chair-idUSBRE91J15820130220?feedType=RSS&feedName=businessNews&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+

reuters%2FbusinessNews+%28Business+News%29; Dawn Kopecki, JPMorgan Investors Urged to Split Chairman Role, Oust Directors, Bloomberg (May 5, 2013) available at http://www.bloomberg.com/news/2013-05-04/jpmorgan-should-name-chairman-to-watch-ceo-iss-tells-investors.html; Paul Hodgson, Where Will The Jamie Dimon Love Fest/Witch Hunt Lead?, Forbes (May 9, 2013) available at http://www.forbes.com/sites/paulhodgson/2013/05/09/where-will-the-jamie-dimon-love-festwitch-hunt-lead/.

- See Melendez, supra note 3.

- Kopecki, JPMorgan Should Replace Most of Board, Glass Lewis Says, Bloomberg Businessweek (May 10, 2013) available at http://www.businessweek.com/news/2013-05-07/jpmorgan-should-split-chairman-and-ceo-roles-glass-lewis-says.

- CenturyLink, Inc., Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, Proxy Access Proposal Item 4(c) (Apr. 9, 2013) available at http://www.sec.gov/Archives/edgar/data/18926/000119312513149066/d470370ddef14a.htm#toc470370_19.

- Elliott founder and principal Paul Singer is chairman of the Manhattan Institute for Policy Research but has had no involvement with the preparation of this report.

- Hess Corporation, Definitive Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934, proposal 8 (2013), http://www.sec.gov/Archives/edgar/data/4447/000119312513119720/d475998ddefc14a.htm#edgtoc475998_17.