PROXY MONITOR 2012

FINDING 1

2012 Proxy Season Under Way

Shareholder advisory firm ISS serving as corporate America’s paymaster

Corporate America’s proxy season—when companies hold annual meetings and shareholders vote on various proposals submitted to them on proxy statements—is now under way. As of March 15, 51 of the largest 200 companies by revenues, as ranked by Fortune

magazine, had announced their annual meetings and mailed proxy materials to

shareholders. Of those companies, 11 have already held meetings, with four

more—Hewlett Packard on March 21, Exelon on April 2, Bank of New York Mellon on

April 10, and United Technologies on April 11—scheduled to meet before the

annual meeting cycle begins in earnest in mid-April.

In 2011, the Manhattan Institute launched its ProxyMonitor.org database, which catalogs shareholder proposals at America’s largest companies. Drawing upon information from the database, we have been examining a growing trend in shareholder activism wherein investors attempt to influence management and corporate practices through the shareholder voting process, sometimes in ways not directly related to maintaining or increasing shareholder value.[1]

This finding summarizes early trends in 2012 shareholder proposal findings and examines 2012 results to date in shareholder advisory votes on executive compensation—including the significant role played by the shareholder advisory firm Institutional Shareholder Services (ISS). This report also looks ahead to significant classes of shareholder proposals on the horizon that I have previously identified as items to watch for this year[2]—proposals relating to corporate campaign finance and political spending, proposals to separate the positions of corporate chairman and CEO, and proposals to grant shareholders proxy access for their director nominees. While votes on these issues have not occurred to date, several such proposals are on proxy ballots in the coming weeks, and we expect these to be major issues during this proxy season.

Overall Shareholder Proposal Trends

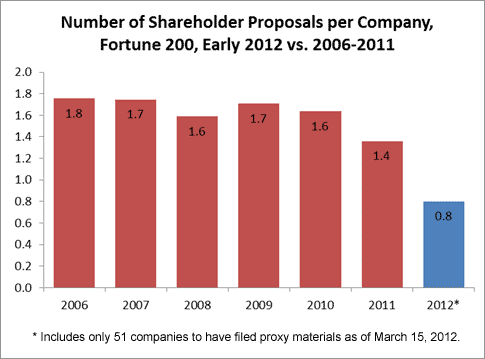

At first glance, as shown in the graph below, the average number of shareholder proposals introduced at Fortune 200 companies thus far in 2012 is below the recent trend line, with only 0.8 proposals filed per company to date this year, versus 1.4 in 2011. When adjusting for the actual companies involved, however, the number of proposals does not vary markedly from that witnessed last year: the 51 companies whose proxy statements were filed as of March 15 only saw 0.88 proposals per company in 2011, versus 0.82 this year—a decrease of only three proposals total.[3] Thus, it appears that 2012 shareholder proposal activity is likely to be similar to that in 2011—slightly below earlier trends, owing primarily to the absence of previously widespread “say on pay” proposals calling for a shareholder advisory vote on executive compensation, a mechanism now mandated under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act.[4] (With management now mandated to submit executive compensation to shareholders, there is no need for shareholders who care about this issue to seek a vote that encourages management to implement the practice.)

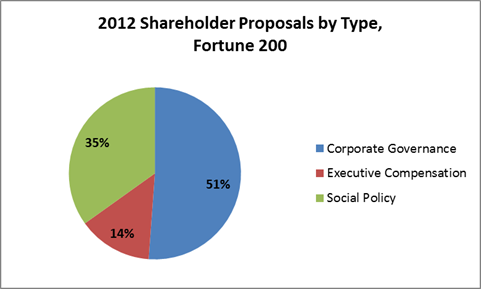

At least at this early stage, there does seem to be some variation in the composition of shareholder proposals introduced in 2012. In 2011, almost 47 percent of all shareholder proposals were unrelated to the company’s executive compensation or the procedural rules of corporate governance but instead concerned social, political, or policy goals such as environmental issues, human rights, or health-care policy. In contrast, such social policy proposals have constituted only 35 percent of all shareholder proposals on corporate proxy ballots this year, and more than half of all proposals have related to corporate governance rules. It will be interesting to see whether this trend continues as more companies’ 2012 proxy materials are distributed.

At least at this early stage, there does seem to be some variation in the composition of shareholder proposals introduced in 2012. In 2011, almost 47 percent of all shareholder proposals were unrelated to the company’s executive compensation or the procedural rules of corporate governance but instead concerned social, political, or policy goals such as environmental issues, human rights, or health-care policy. In contrast, such social policy proposals have constituted only 35 percent of all shareholder proposals on corporate proxy ballots this year, and more than half of all proposals have related to corporate governance rules. It will be interesting to see whether this trend continues as more companies’ 2012 proxy materials are distributed.

Say on Pay: The Role of ISS

The year 2011 was the first in which all public companies had to submit executive-compensation packages to a shareholder advisory vote under the Dodd-Frank Act. Because the overwhelming majority of companies saw shareholders vote to review executive pay annually,[4] most companies will face say-on-pay votes again in 2012.

Among the 11 Fortune 200 companies to have held shareholder votes on executive compensation to date in 2012, a majority of shareholders approved pay packages at each company.[5] Actual vote totals varied significantly, however, and this variation demonstrates the substantial role being played by ISS in such voting. ISS recommended that shareholders vote against executive pay at four of the 11 companies—Johnson Controls, Navistar, Qualcomm, and Walt Disney—and these companies received, on average, 64 percent support from shareholders in advisory executive-pay votes, ranging from 71 percent at Navistar to 57 percent at Disney.[6] In contrast, the other seven companies, for which ISS supported pay packages, received, on average, 94 percent support; only Apple, with a new CEO replacing longtime chief Steve Jobs, received under 90 percent backing (83 percent).

While these results do not demonstrate conclusively that ISS’s negative recommendations caused the lower shareholder support (it’s conceivable that ISS and all investors rejected pay packages for the same reasons and that some defect in the packages independently motivated shareholder opposition), it seems very likely that ISS’s position substantially influenced the shareholder vote.[7] An unintended side effect of the Dodd-Frank-mandated shareholder advisory votes on executive compensation would thus seem to be giving a significant and far-reaching “gatekeeper” role over executive pay to ISS, a single private firm giving nonpublic shareholder-vote advice to institutional investors.

While these results do not demonstrate conclusively that ISS’s negative recommendations caused the lower shareholder support (it’s conceivable that ISS and all investors rejected pay packages for the same reasons and that some defect in the packages independently motivated shareholder opposition), it seems very likely that ISS’s position substantially influenced the shareholder vote.[7] An unintended side effect of the Dodd-Frank-mandated shareholder advisory votes on executive compensation would thus seem to be giving a significant and far-reaching “gatekeeper” role over executive pay to ISS, a single private firm giving nonpublic shareholder-vote advice to institutional investors.

The influence of ISS recommendations on shareholder votes on executive pay also sheds light on the likely impact of ISS’s new rule, proposed in fall 2011, to challenge management to respond whenever fewer than 70 percent of shareholders have voted for management’s executive-compensation packages in the previous year, even if a majority of shareholders approved. Given that three of the four large companies whose pay was challenged by ISS this year fell under the 70 percent threshold, ISS’s policy effectively acts to increase its power over management pay, even as most shareholders reject the firm’s recommendations. It is questionable whether moving all large-company executive-pay methodologies into ISS-approved packages is for the better, whether or not ISS is generally correct in its executive-pay assessments. Evaluating ISS’s role here is complicated by the fact that the firm’s recommendations and analyses are not public, and this opacity is of even greater concern given that many of the firm’s clients—who pay its bills—are shareholders such as labor-union pension funds and social-investing funds that may be motivated by issues other than maximizing shareholder value.

Shareholder Proposal Issues to Watch For

To date, none of the 11 companies holding shareholder meetings has faced proposals related to political spending, separating the positions of chairman and CEO, or proxy access for shareholder-nominated directors—the three key issues that I highlighted in my winter report.[8] (Apple did face a proposal related to political spending, but it was not presented at the annual meeting.) Some such proposals are looming on the horizon, however, and they will merit watching.

Political Spending

Among companies to have filed proxy information, seven companies face eight proposals related to political spending or lobbying:

- Citigroup, meeting April 17, has a proposal submitted by the Firefighters’ Pension System of the City of Kansas City, Missouri, asking the company to make semiannual disclosures of all political spending, including contributions to political candidates, parties, or entities or non-tax-exempt organizations; and requiring the company to disclose the purpose of each such contribution.

- Honeywell, meeting April 23, has a similar proposal submitted by Vijay Sendhil Revuluri, which additionally requires that the company post the semiannual report on its website and disclose the “title(s) of the person(s) in the Company responsible for the decision(s) to make the political contributions or expenditures.”

- BB&T Corporation, meeting April 24, has a proposal submitted by the Massachusetts Laborers’ Pension Fund that is virtually identical to the political spending proposal submitted by the Firefighters’ Pension System to Citigroup.

- IBM, meeting April 24, faces a pair of proposals related to political spending. The first, sponsored by the social-investing fund Walden Asset Management, asks the company’s independent directors to “institute a comprehensive review of IBM’s policies and oversight processes related to political spending and public policy, both direct and indirect including though trade associations, and present a summary report by September 2012,” with a particular focus on the company’s role with the U.S. Chamber of Commerce. The second, sponsored by another social-investing fund, Green Century Capital Management, asks the company to prepare an annual report on lobbying policy and priorities, including a list of all payments, including to trade associations and grassroots lobbying organizations, and “[m]embership in and payments to any tax-exempt organization that writes and endorses model legislation,” and to post the report on the company website.

- Johnson & Johnson, meeting April 26, has a proposal submitted by James Mackie resolving that the company shall not make any political contributions without the prior consent of 75 percent of shareholders.

- AT&T, meeting April 27, has a proposal co-filed by the social-investing fund Domini Social Investments and three Catholic religious orders, substantially the same as that submitted to Honeywell.

- United Parcel Service, meeting May 3, has a proposal submitted by Walden Asset Management, substantially the same as the lobbying-related proposal submitted by Green Century Capital Management to IBM.

Chairman Independence

Six companies face forthcoming proposals seeking to separate the positions of chairman and CEO:

- Bank of New York Mellon, meeting April 10 (sponsored by the Trowel Trades S&P 500 Index Fund)

- Honeywell, meeting April 23 (sponsored by John Chevedden)

- General Electric, meeting April 25 (sponsored by William Steiner)

- Johnson & Johnson, meeting April 26 (sponsored by the American Federation of State, County, and Municipal Employees [AFSCME])

- Lockheed Martin, meeting on April 26 (sponsored by AFSCME)

- AT&T, meeting April 27 (sponsored by John Chevedden on behalf of Kenneth Steiner)

Proxy Access

This is the first year since 2007 in which the Securities and Exchange Commission (SEC) has permitted shareholders to submit proposals granting proxy ballot access to shareholder-nominated directors. (Such proposals were held in abeyance while the SEC proposed a mandatory proxy-access rule, rejected last summer by the U.S. Court of Appeals for the D.C. Circuit.)[9] While shareholders did, as expected, submit several such proposals, many of these submitted in the early part of the proxy season failed to meet specifications necessary for ballot inclusion: the SEC submitted no-action letters permitting various companies, including Bank of America, Goldman Sachs, and Sprint Nextel, to exclude such proposals for technical defects.[10] One Fortune 200 company, however, does have such a measure submitted for a vote at an upcoming meeting:

- Wells Fargo, meeting April 24, has a proposal submitted by Norges Bank Investment Management, a division of Norges Bank, the central bank of the Government of Norway, permitting shareholders who have owned 1 percent of the company’s shares continuously for at least one year to nominate directors, up to 25 percent of the total directors up for nomination.

This report analyzes information gathered from the Manhattan Institute’s ProxyMonitor.org database, which contains information relating to all shareholder proposals submitted for shareholder vote since 2006, for the 200 largest American public companies.[11]

ENDNOTES

- See http://www.proxymonitor.org/Forms/reports_findings.aspx.

- See James R. Copland, Shareholder Activism: What to Watch for in the 2012 Proxy Season, Proxy Monitor Rpt. (Manhattan Institute, Winter 2012), available at http://www.proxymonitor.org/Forms/pmr_03.aspx.

- There is some company-to-company variation in the number of proposals to reach proxy ballots. E.g., Citigroup, General Electric, and Walt Disney each received one proposal fewer in 2012 as compared with 2011; Apple and Eli Lilly each received two more proposals this year.

- Pub. L. No. 111-203, 124 Stat. 1376 §951 (2010) [hereinafter Dodd-Frank Act]; 17 C.F.R. § 229.402 (2011).

- See James R. Copland, A Report on Corporate Governance and Shareholder Activism, Proxy Monitor Rpt. (Manhattan Institute, Fall 2011), available at http://www.proxymonitor.org/Forms/pmr_02.aspx (“Although boards of directors variously recommended triennial and biennial pay review, the shareholders of only six companies of the Fortune 150 to have considered the question to date opted for other than annual review: Berkshire Hathaway, Google, Tyson Foods, UPS, Comcast, and Nucor.”).

- Note that because executive-compensation advisory proposals are introduced by management, majority support indicates that most shareholders backed management’s proposal. In contrast, shareholder proposals—including say-on-pay proposals prior to Dodd-Frank—are almost universally opposed by management, so that a majority vote for the proposal indicates that most shareholders disagreed with management’s position.

- Johnson Controls, Qualcomm, and Disney each filed additional materials arguing against ISS’s position.

- Because ISS reports and recommendations are not a matter of public record, it is difficult to assess the rationale underlying the proxy advisory firm’s objections.

- See James R. Copland, supra note 2.

- See Business Roundtable v. SEC, 647 F.3d 1144 (D.C. Cir. 2011).

- See Emily Chasan, Proxy Access Attempts Failing Before They Begin, CFO J., March 13, 2012, at http://blogs.wsj.com/cfo/2012/03/13/proxy-access-attempts-failing-before-they-begin/?mod=google_news_blog.